About us

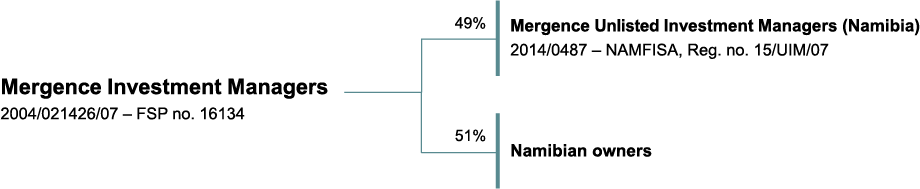

Mergence Unlisted Investment Managers (Namibia) (“Mergence Namibia”) is a majority Namibian-owned asset manager that is registered as an unlisted investment manager (“UIM”) in accordance with Regulation 29. The company operates in partnership with South African investment manager Mergence Investment Managers (Pty) Ltd., which owns a 49% stake in Mergence Namibia.

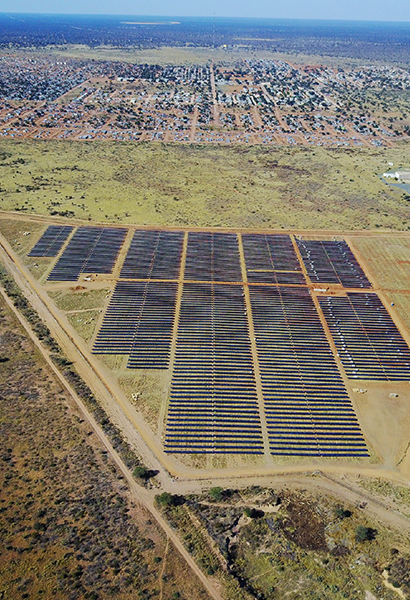

Our primary focus is to identify and optimise unlisted businesses and projects that hold significant impact potential for the Namibian economy. Our experience in the private equity and impact arenas, coupled with our specialised skill set, enables us to execute unlisted investments successfully and sustainably, to the benefit of our investors and the social and economic advancement of the Namibian nation.

Who We Are

Mergence Namibia was incorporated in June 2014. The company is majority Namibian-owned, with the balance owned by its technical partner Mergence Investment Managers in South Africa.

Mergence is a socially responsible investment management firm based in Southern Africa. Since 2008, we have been signatories to the Principles of Responsible Investment (PRI), supported by the United Nations. We encourage the companies we invest in to balance profits with socially responsible practices by incorporating environmental, social, and governance (ESG) issues into our investment process.

We also guide investors to actively manage their environmental impact while maintaining high standards of corporate governance. Our innovative range of infrastructure and development funds is a source of pride for us. Our team members are highly skilled and have been acknowledged for their exceptional work in this field.

OUR FUNDS

- Climate change and resource scarcity

- Rapid urbanisation

- Demographic and social change

- Technological breakthroughs

- Shift in global economic power

News & Insights

For our latest news and thought pieces, please visit the Mergence Investment Managers website.

Contact Us

Mergence Windhoek

Heritage Square

1st Floor, Building No.2

c/o Robert Mugabe Avenue & Lindequist Street Windhoek

T +264 (0)61 244 653

Mergence Maseru

House 369 Malibamats’o Street

Lower Thetsane

Maseru, Lesotho

T +266 52500040/50

Mergence Cape Town

2nd Floor Cape Town Cruise

Terminal Duncan Road, V&A Waterfront

Cape Town

F +27 21 433 0675

Mergence JHB

Block A1, 34 Impala Rd, Chislehurston,

Sandton, Johannesburg, Gauteng,

South Africa

T +27 11 325 2005

F +27 11 325 7597