7 September 2023

It may seem strange for a South African institutional investor to spend too much time thinking about the US housing market; it is, after all, a retail asset class on the other side of the world. But the cost of housing is the largest component in the US CPI basket (35% of the CPI basket and 44% of the Core CPI), and the future trajectory of US inflation is a key driver of US and therefore global interest rates.

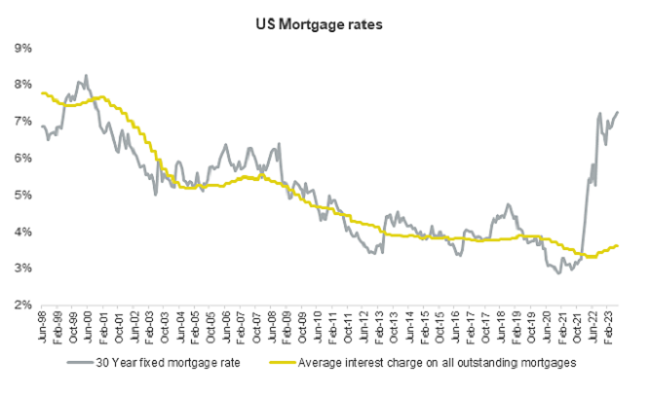

The chart below shows the interest rates on new mortgages in the US versus the average interest rate actually being paid on current mortgages. US consumers have the ability to select either fixed or floating rate mortgages, and over the years from 2013 to 2020, with mortgage rates at record lows, many of them opted for fixed rates.

Source: Bloomberg

This means that while the Fed has hiked interest rates significantly over the past 12 months and mortgage rates have just seen their sharpest increase in the past 30 years, the actual interest rate being paid has not increased nearly as much.

This has dampened one transmission mechanism of the Fed’s rate hikes into the US economy and kept the housing market more resilient than it otherwise would have been in the face of such steep interest rate increases. This has also slowed the turnover in the housing market. Consumers who locked in a 30-year mortgage at 3% in 2020 are disinclined to move home if their new mortgage will be at a 7% rate.

Another feature of housing inflation is that the official series is slow-moving.

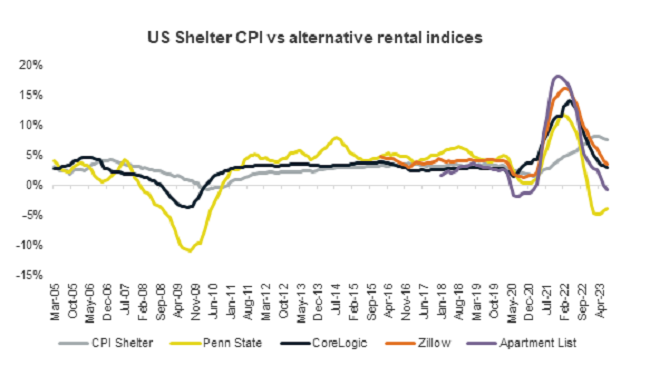

The chart below shows the Shelter component of the Cpi vs a number of alternative data series measuring year on year rental increases. The difference in these series is that the alternative series all capture the change in current new rentals, while the CPI captures the change in rentals and housing costs across the entire economy, including for those renters or homeowners who have not recently moved or negotiated a new lease.

Source: Bloomberg

These near-term alternative data sets clearly suggest that the shelter component of US CPI will be disinflationary over the next few months as slowing and even falling new rentals filter into the official data. In the longer term, as long as mortgage rates remain high, it is difficult to see house prices and rental growth reaccelerating strongly.

The key question that remains is where US shelter inflation will settle in the long term. But the dynamics above, coupled with long-term demographic trends in the US, are two strong arguments that US inflation will continue to moderate back towards the Fed’s target level and an argument supporting a position in US sovereign bonds at yields above 4%.

Our Market Snippets aim to provide concise insight into our investment research process. Each week, we highlight one chart that showcases our research, motivates our current positioning, or simply presents something interesting we’ve discovered in global financial markets.

For more of our current market views, please visit our website.