For our latest company News & Insights, please visit our Mergence Investment Managers website.

Mergence provided equity and debt financing for two adjacent solar power plants with a combined output of 10 megawatts (MW), which reached Commercial Operation Date in August 2018 as part of the Namibia Feed-in Tariff (REFIT) programme.

The programme was initiated by Nampower and the Electricity Control Board to establish Independent Power Producers in Namibia. The Ejuva projects are backed by a 25-year Power Purchase Agreement with Nampower and feed an estimated 25.8 GWh (gigawatt hours) per year into Namibia’s national grid.

In addition to a 66% equity stake in each project, Mergence advances loans to finance the equity position of local shareholders in both Ejuva plants.

In June 2020 Mergence purchased a majority stake in the 6MWp MSO energy plant near Keetmanshoop from Canadian Solar, one of the world’s largest solar power companies.

In line with twin projects and in support of the localisation of the solar industry for Namibians, Mergence ensured that there was full and equal participation for a local counterparty. The project will provide CPI-linked solar power generation revenue for 25 years under the REFIT programme, generating approximately 14,800 MWh of clean energy each year. The project further illustrates enhanced corporate governance in investee companies by Mergence.

The positive impact of this project:

Through our renewable energy investment portfolio and similar pipeline projects, Mergence strives to create shared and sustainable value by actively pursuing:

Mergence provided mezzanine funding of 46% bulk infrastructure development (land servicing of 106 erven, Phase 1) in Auasblick Extension 1, under a Public Partnership Agreement with the City of Windhoek and Sinco Investments, trading as PPH Auasblick. The PPP was initiated to help address the need for affordable housing and deliver 106 erven to the City of Windhoek. The township will comprise single and general residential erven, public open spaces, and institutional land.

The positive impact of this project:

Generating positive social impact along with CoW on PPP initiatives and building innovative partnerships that lead to access to affordable land and the creation of jobs.

Meeting the need for basic services such as residential houses, health care, schools, recreational facilities, sustainable development, and shopping areas.

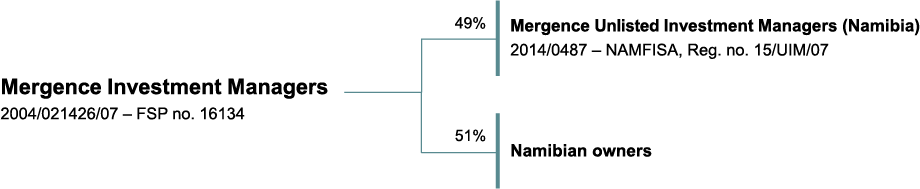

Mergence Unlisted Investment Managers (Namibia)

Mergence Unlisted Investment Managers (Namibia) Proprietary Limited is a licenced investment manager in terms of the Stock Exchanges Control Act 1 of 1985.

Stock Exchanges Control Act 1 of 1985

Mergence Unlisted Investment Managers (Namibia) Proprietary Limited is a licenced investment manager in terms of the Stock Exchanges Control Act 1 of 1985. All references to “Mergence” include Mergence Unlisted Investment Managers (Namibia) Proprietary Limited, as well as all other entities within the Mergence group of companies, as the context indicates. Mergence is not authorised to and does not provide financial advice. All information contained on this website should not be construed or relied upon as advice. If you require financial and/or investment advice, please engage the services of an independent financial adviser.

Content

The information and content (collectively ‘information’) accessible through this website is provided by Mergence as general information about Mergence and its products and services. Mergence does not guarantee the suitability or potential value of any information or particular investment source. Any information on this website is not intended to provide financial, tax, legal, investment, or other advice. You are solely responsible for determining whether any investment, investment strategy, security, or related transaction is appropriate for you based on your personal investment objectives, financial circumstances, and risk tolerance. It is recommended that you consult an independent financial adviser regarding your specific situation if you require financial and/or investment advice. Nothing contained in any service provided or any content on this website constitutes a solicitation, recommendation, endorsement, or offer by Mergence, including in regard to buying, selling, or holding any securities or investments, but shall merely be considered to be an invitation to do business.

Ownership and copyright

The information and content (collectively ‘information’) accessible through this website is provided by Mergence as general information about Mergence and its products and services. Mergence does not guarantee the suitability or potential value of any information or particular investment source. Any information on this website is not intended to provide financial, tax, legal, investment, or other advice. You are solely responsible for determining whether any investment, investment strategy, security, or related transaction is appropriate for you based on your personal investment objectives, financial circumstances, and risk tolerance. It is recommended that you consult an independent financial adviser regarding your specific situation if you require financial and/or investment advice. Nothing contained in any service provided or any content on this website constitutes a solicitation, recommendation, endorsement, or offer by Mergence, including in regard to buying, selling, or holding any securities or investments, but shall merely be considered to be an invitation to do business.

Email legal notice

For our email legal notice, click here.

Privacy policy

For details about our privacy policy, click here.

Complaints procedure

For details about our complaint procedure, click here.

Conflict of interest management policy

For details about our conflict-of-interest management policy, click here.

Important information

The content on this website and the information contained therein are made available to you ‘as is’ and ‘as available’. Mergence has taken and will continue to take care that all information provided on this website is true and correct in so far as it is under Mergence’s control. However, Mergence does not warrant that this website, the content provided, or the information contained therein will be error-free or will meet any particular criteria of accuracy, completeness, or reliability of information, performance, or quality, and disclaims any liability for any loss, damage (whether direct or consequential), or expense of any nature whatsoever which may be suffered as a result of or which may be attributable, directly or indirectly, to the use of or reliance upon any information, links, or service provided through this website. Although Mergence has taken reasonable measures to ensure the integrity of this website, including the content provided and the information contained therein, there is no warranty of any kind, expressed or implied, made by Mergence regarding the information or aspect of any service provided. Any warranty implied by law is hereby excluded, except to the extent that such an exclusion would be unlawful.

Mergence reserves the right to suspend, terminate, or modify this website, email services, or these terms of use at any time without notice. Any changes will be implemented, and you can access them at Legal Information. If you use this website after the changed terms of use have been posted, you will be deemed to have accepted the changed terms of use.

Governing law

The content contained on this website will be interpreted and implemented in accordance with the laws of Namibia.

Email Legal information for Mergence Namibia

Your use of our email services, including the receipt via email of fact sheets, minimum disclosure documents, periodic reports and/or price and performance information, is subject to your acceptance of and compliance with our terms of use. By using our website or email services, you agree and accept all of our terms of use.

Stock Exchanges Control Act 1 of 1985

Mergence Unlisted Investment Managers (Namibia) Proprietary Limited is a licensed investment manager in terms of the Stock Exchanges Control Act 1 of 1985. All references to “Mergence” include Mergence Unlisted Investment Managers (Namibia) Proprietary Limited, as well as all other entities within the Mergence group of companies as the context indicates. Mergence is not authorised to and does not provide financial advice. All information contained on this website should not be construed, or relied upon, as advice. If you require financial and/or investment advice, please engage the services of an independent financial adviser.

Confidentiality warning

The contents of this email and any accompanying documents are confidential and may be subject to legal privilege and client confidentiality. Any use of these, in whatever form, by anyone other than the addressee is strictly prohibited. If you are not the intended recipient of this email or facsimile, kindly notify the sender by return email, fax or phone call and please dele it from your system and/or device. You may not copy this email or disclose its contents to any other person, without Mergence’s express written consent.

Ownership and copyright

The contents of this email and any accompanying documents relating to Mergence and its subsidiaries and associated companies are owned by Mergence and are protected by copyright and other intellectual property laws. All rights not expressly granted are reserved. Any unauthorised copying, reproduction, retransmission, distribution, dissemination, sale, publication, broadcast or other circulation, or exploitation of this material will constitute an infringement of such protection. Without detracting from the above, Mergence hereby authorises you to view, download, print and distribute the content of this email and any accompanying documents, provided the content is used only for your information, non-commercial and private purposes. The copyright in all material vesting in Mergence provided through email services shall continue to vest in Mergence. You are expressly prohibited from incorporating any proprietary material of Mergence and/or its licensors taken from this email in any other work, publication, email or website either of your own or belonging to any third party. Nothing contained in this email should be construed as granting any licence without the prior written permission of the owner and no right, title or interest in any proprietary material contained in this email is granted to you.

Electronic communications

By communicating with Mergence through electronic means, you consent to receiving communications electronically and agree that all agreements, notices, disclosures and all other communications transmitted by electronic means satisfy any legal requirement, including but not limited to the requirement that such communication should be in writing. Unless otherwise agreed, an email is only considered to be received by Mergence once Mergence has confirmed receipt; and an email is only considered to be sent by Mergence once reflected as ‘sent’ on the Mergence email server.

Important information

Mergence has taken and will continue to take care that all information provided in this email is true and correct, in so far as this is under Mergence’s control. However, Mergence does not warrant that this email, the content provided or information contained therein will be error-free or will meet any particular criteria of accuracy, completeness or reliability of information, performance or quality and disclaims any liability for, any loss, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered as a result of or which may be attributable, directly or indirectly, to the use of or reliance upon any information, links or service provided through this email. Furthermore, Mergence shall not be liable if any variation is made to any document or correspondence emailed unless the variation has been approved by the sender. Mergence cannot and will not be held liable for any harm or loss resulting from viruses in this email or accompanying documents, including data corruption resulting therefrom. Mergence disclaims liability or legal responsibility for the non-delivery or incorrect delivery for whatever reason of the contents of this email, its effect on electronic devices or its transmission in an unencrypted medium.

Although Mergence has taken reasonable measures to ensure the integrity of this email, including the content provided and the information included, there is no warranty of any kind, expressed or implied made by Mergence, regarding the information or any aspect of any service provided. Any warranty implied by law is hereby excluded except to the extent that such exclusion would be unlawful.

Mergence reserves the right to suspend, terminate or modify the email services or these terms of use at any time without notice. Any changes will appear in this document, which you can access at any time. If you use the email services after the changed terms of use have been posted, the changed terms of use will be considered as accepted by you.

Personal use by employees

Mergence is not able to distinguish between business and personal emails. Users who make use of Mergence’s email system do so at their own risk and accept responsibility for any actions or consequences that arise from such personal use. Any views or opinions expressed in such emails are those of the individual sender and do not necessarily create obligations on or represent any commitment or view by, or opinion of Mergence. If you are unsure of the content or information contained in an email, it is advised that you seek written confirmation from Mergence before relying on the content and/or information. If an email contains offensive, derogatory or defamatory statements or materials, it means the email has been sent outside the sender’s scope of employment with Mergence and therefore only the sender can be held liable in his/her personal capacity.

Interception and monitoring

Users who make use of Mergence’s email system do so at their own risk and accept responsibility for any actions and consequences that arise from such use. In general terms, Mergence does not engage in blanket monitoring of communications. Mergence does however reserve the right at any time and without notice to intercept and monitor communications and stored files sent or received over or stored on Mergence’s information and communications systems, provided that such monitoring and interception is performed by a Mergence representative properly authorised by Mergence; and for a lawful purpose.

Offer

Nothing contained in this email constitutes a solicitation, recommendation, endorsement or offer by Mergence, including regarding buying, selling or holding any securities or investments, but shall merely be considered as an invitation to do business.

Governing law

This email and any accompanying documents will be interpreted and implemented according to the laws of Namibia.

Company details

Registered name:

Mergence Unlisted Investment Managers (Namibia) Proprietary Limited

(Registration no: 2014/0487)

Address:

1st Floor, Heritage Square, Building No.2, c/o Robert Mugabe Avenue

and Lindeguist Street, Windhoek, Namibia

Directors:

NO Shiluwa-Marino, FR de Beer, B Jack, JK Afordofe, TJ Katjire, JTP Hitula

Company secretary:

BDO Namibia

Contact:

For further information please contact the Executive Director at hileni@mergence.com.na

We have proudly spearheaded numerous successful renewable energy projects and bulk infrastructure PPP initiatives within our inaugural fund, an infrastructure equity-focused fund.

Below is a snapshot of some of our portfolio companies:

After the success of our inaugural unlisted fund in Namibia, which is now fully invested, Mergence Namibia has launched the Mergence Real Asset Fund. This fund is open to investors, and we aim to create sustainable shared value within the following Namibian sectors:

Digital

infreastructure

Affordable

housing

Student

accomodation

Healthcare

BTech Human Resources Management

Katchina Shiluwa-Marino, known as Ms. Shiluwa-Marino, is an entrepreneur and Executive Director with a Bachelor’s Technikon Degree in Human Resources. She began in Namibia’s fishing industry before co-managing a human resources consulting firm for nearly two decades. Beyond her ventures, she advises, directs, and invests in various industries. Committed to education’s role in national development, she champions skills development and supports a kindergarten/primary school she helped establish privately, embodying her dedication to Namibia’s growth.

BCom

Tobias is an experienced accountant who completed his articles with BDO Namibia in 2006, followed by five years at a large Namibian state-owned company, of which three years were as General Manager: Finance, Administration, and IT. In early 2012, he started his own consultancy and has consulted on strategic and operational engagement in financial and control environments. Tobias has a BCom from the University of Namibia (2000) as well as non-degree courses from the University of South Africa (UNISA) in management accounting, commercial law, and business management.

BCom (Accounting & Economics), H.Dip.Ed

Fabian joined Mergence in 2006. He has over 34 years’ experience in financial services, specialising in investment and macro strategy. Fabian’s primary focus is on investment risk, compliance, and regulatory matters across Public and Private markets. He serves on the Mergence Group Board as well as the in-country Boards where Mergence operates. He has held senior and executive management positions at major SA banks and retirement funds.

MBA (Strategy), BCom (Accounting), BCom Hons (Fin Planning)

Semoli joined Mergence in 2017 as Regional Investments Strategist. He has 20 years’ experience, including as a fund accountant, investment consultant and business development executive. With a strong network of contacts throughout the Southern African Development Community (SADC), he is also a non-executive director on several company boards. Semoli serves on the executive committee of Mergence Investment Managers.

BCom (Accounting), PG Dip (Accounting), CA(SA)

John joined Mergence in November 2018 as General Manager: Operations. He was promoted to Chief Operating Officer in 2019. In September 2021 his role at Mergence was specialised into Chief Financial Officer as part of high-level changes to the Mergence executive leadership team to meet the company’s strong growth. John serves on the executive committee of Mergence Investment Managers.

BBusSc, Postgraduate Diploma in Investment & Portfolio Management

Hileni joined Mergence Unlisted Investment Managers (Namibia) as a portfolio manager in 2017. She has over 15 years of experience in financial services. At Mergence she has transacted on and overseen infrastructure and impact investments on behalf of Namibia’s largest retirement fund, including three renewable energy projects, and a bulk infrastructure/land servicing project.

BCom (Actuarial Science, Quantitative Finance)

BCom Hons (Finance)

MPhil (Development Finance)

CFA® Charterholder

Mosa joined Mergence in 2023 as a Senior Investment Associate in the Private Markets team. Previously, she worked at the International Finance Corporation, the Public Investment Corporation, and Momentum Metropolitan Holdings in various investment roles. She is also involved in lecturing and foundation trustee work.

BBusSc, Postgraduate Diploma in Investment & Portfolio Management

Hileni joined Mergence Unlisted Investment Managers (Namibia) as a portfolio manager in 2017. She has over 15 years of experience in financial services. At Mergence she has transacted on and overseen infrastructure and impact investments on behalf of Namibia’s largest retirement fund, including three renewable energy projects, and a bulk infrastructure/land servicing project.

BCom (Actuarial Science, Quantitative Finance)

BCom Hons (Finance)

MPhil (Development Finance)

CFA® Charterholder

Mosa joined Mergence in 2023 as a Senior Investment Associate in the Private Markets team. Previously, she worked at the International Finance Corporation, the Public Investment Corporation, and Momentum Metropolitan Holdings in various investment roles. She is also involved in lecturing and foundation trustee work.

BBusSc Hons

Tshepiso joined Mergence in Johannesburg in 2018 following 11 years of experience in the deal team of a private equity house. At Mergence Tshepiso has worked on deals in medicinal cannabis, primary healthcare, affordable housing, agri-finance, specialised healthcare, waste management, secondary mining, student accommodation, financial inclusion and fintech spaces.

BCom (Financial Accounting), PGDA, CA(SA)

Nandipha joined Mergence as a risk manager in the Private Markets investment team in June 2017. She has six years of experience working as an external and internal investment auditor. Nandipha’s responsibilities at Mergence include ensuring that governance, risk, and control frameworks are effective and that all investment activities, across all markets, sectors, and deals are in accordance with applicable legislation, regulation, and client mandates.

BSc Hons, MCom (Financial Management), ACCA

16 years industry experience; 12 years with Mergence

Chito joined Mergence in 2011 as an equity analyst in the public markets’ investment team focused on FMCG, hospitality, financial services, and telecommunications before transitioning to the private markets investment team in 2015. As Investment Principal, Chito focuses on private market investment opportunities within SADC. He has led transactions in the aquaculture and microfinance sectors and serves on the boards of several investment companies.

BSc (Finance & Accounts)

PGDip (Accounting)

CA(SA)

Rizaan joined Mergence in 2022 as an Investment Associate. He is a trained investment professional with extensive post-qualification experience in investment banking, asset management, and renewable energy debt investment. He is responsible for the origination and execution of deals in the SADC region for Mergence’s Equity and Debt funds, with a focus on infrastructure finance, renewable energy, and other clean energy investment opportunities.

BCom (Investment Management and Banking), BCom Hons

1 year industry experience; 1 year with Mergence

Linkeng joined Mergence Investment Managers (Lesotho) in 2022 as a trainee analyst, where she supports the investment analyst team within private markets. Her role encompasses assisting with the origination of opportunities and guiding them through the investment process to implementation. Linkeng has team leadership skills, having been an SRC exco member at university.

BA (Economics), PGD (Property Management & Development), MBA (Finance)

6 years industry experience; 1 year with Mergence

Ntsebeng joined Mergence Investment Managers (Lesotho) as a property analyst in 2022. She has six years of experience, including time spent as a real estate specialist and data analyst. Her responsibilities at Mergence include analysing the economic drivers of the commercial property portfolio and assessing the financial opportunity for existing and potential property investments.

BCom

Tobias is an experienced accountant who completed his articles with BDO Namibia in 2006, followed by five years at a large Namibian state-owned company, of which three years were as General Manager: Finance, Administration, and IT. In early 2012, he started his own consultancy and has consulted on strategic and operational engagement in financial and control environments. Tobias has a BCom from the University of Namibia (2000) as well as non-degree courses from the University of South Africa (UNISA) in management accounting, commercial law, and business management.

Bachelor of Business Administration, Higher Certificate in Management.

Fyritta joined Mergence Unlisted Investment Managers (Namibia) in 2017. She was appointed as an administrative assistant, excelling in reception, secretarial tasks, and operating the switchboard. Adept at managing diverse responsibilities, from mail services to coordinating board meetings and maintaining office inventory, Fyritta is adaptable, reliable, and thrives in crises. She has a Bachelor of Business Administration and a Higher Certificate in Management.

National Diploma (Internal Auditing), BTech (Internal Auditing)

Vicky joined Mergence as a Client Relationship Manager in 2014 and leads the CRM team. In 2007, she began her career at State Street, working initially as a fund accountant, then as a manager within the asset owner and sovereign wealth division and subsequently as a business risk analyst.

BA (Fine Arts), BCom (Informatics)

Ronel joined Mergence in 2010 as a Business Development Manager with a focus on a combination of functions, including client retention, product development, institutional business growth, and marketing/media strategy. In 2019 she was promoted to Head: Marketing and Public Relations for Mergence Group. Previously Ronel worked for Goldman Sachs in London, followed by various South African fund managers.

Mergence embraces the multi-culturalism and multi-racial diversity of Southern Africa, and we are building businesses that reflect this. We are committed to building a better future for our communities, children, the environment and our country.

We are building and uplifting our communities to help ensure they are healthy, educated, and cared for.

The following project, among others, form part of Mergence’s corporate social investment in Namibia.

Mergence Unlisted Investment Managers (Namibia) made a remarkable contribution to the Alumni and Namibia University of Science and Technology (NUST) Foundation by donating office furniture valued at over N$50,000. This generous donation significantly enhanced the department’s workspace, providing a more comfortable and efficient environment for staff and visitors. The new furniture included desks, chairs, filing cabinets, and other essential office items, all of which supported the department’s ongoing efforts to engage with alumni and foster relationships that benefit the entire university community. Our support to this project is a testament to our commitment to education and sustainable shared value in Namibia.

Administration

At Mergence, we focus on our core competency, which is fund management. As such, our fund administration is outsourced to an independent service provider, Apex Group. Mergence Unlisted Investment Managers (Namibia) has the same arrangement, but with the relationship management of the outsource administration service being managed from Namibia.

Back-up & Disaster Recovery Plan (DRP)

We make regular backups of all our data and have an off-site disaster recovery facility. The DRP ensures that we will be able to continue operating in the event of a disaster while we re-establish and set up a permanent office.

Conflict of Interest

Our “Conflicts of Interest Policy and Conflict Management Framework” outlines Mergence’s adopted policy for conflicts of interest among employees, key individuals, and representatives. Should you require it, a copy of this document is readily available upon request.

Complaints Handling Procedure

Mergence Unlisted Investment Managers (Namibia) Pty Ltd. has systems in place for the purpose of timely and efficient resolution of complaints within the specified timeframes. Our complaint handling procedure is documented and available on request.

Global Investment Performance Standards (GIPS)

These standards govern the preparation and presentation of performance numbers, and although compliance with them is voluntary, Mergence adopts the standards as they are considered best practice.

Regulation and Compliance

Legal compliance is also outsourced. EIS Namibia and PwC are currently engaged, and ongoing external compliance or is? outsourced to Compli-Serve SA. Compli-Serve SA is a leading independent specialist provider of advisory and operational compliance services to the financial services sector. Internally, the Executive Director is accountable for compliance. Regular communication with PwC and NAMFISA ensures that Mergence is up to date with the latest regulatory changes and complies with the necessary requirements.

Mergence believes that the safe and optimal functioning of infrastructure is one of the crucial building blocks for economic growth. Through a collective effort and a common purpose to prioritise this, we are well positioned to help generate and fast-track social, environmental, and economic returns to investors and to the people of Namibia.

As a committed impact investor, our primary focus is on infrastructure and developmental investments in line with the Mergence Group ethos of “creating sustainable shared value”.

Our objective is to be recognised and rated as a premier investment manager by our clients, prospective clients, and industry participants, to grow Mergence over time, and to offer additional, more traditional fund offerings in the form of equity and multi-asset class funds.

Excellence

Inclusion

Integrity

Transparency

Teamwork

We believe that specialised fund managers such as Mergence can play a significant role in providing debt and/or equity funding to projects in the fields of energy, health, education, digital infrastructure, land delivery, and help to drive Public-Private Partnerships (PPPs) between government and the private sector.

As such, our portfolio is structured to pursue the following outcomes:

Our clients include institutional pension funds, government agencies, fund managers, and multi-managers within the SADC region. By providing comprehensive unlisted investment management services to our clients, we aim to generate shared value by:

It is our longstanding belief that companies cannot achieve sustainable economic success while neglecting their social and environmental responsibilities. Responsible investing forms an intrinsic part of our investment processes and supports our mission in creating sustainable shared value through delivering positive risk-adjusted returns for our clients while making a significant positive impact on society and the environment.

Engagement with companies and voting at shareholder meetings are both powerful tools that we have considered to be an essential part of our active management offering since the very beginning of our responsible investing journey. We were one of the first South African asset managers to make public its proxy voting decisions. Click here to view our historic proxy voting records.

CLICK HERE to view our historic proxy voting records.

We have been early supporters of initiatives guiding responsible investing, including:

Our investment processes deliberately include ESG considerations which are continually refined, updated and enhanced by the investment teams.

Our Public Markets team have an explicit ESG pillar and minimum ESG deliverables as part of their equity research process and portfolio construction. Similarly, the Private Markets team have an ESG management system which details how they incorporate ESG issues into the investment decision-making process with a view to mitigating overall portfolio risk, promoting sustainability, and generating positive impact. The system also spells out our ESG requirements of investee companies.

At Mergence, we believe in the power of People, Planet and Prosperity, acknowledging that making profits can only be justified if people and the planet are respected and preserved in the process. Our ethos of creating sustainable shared value is at the heart of our business. Making a positive impact on society, embracing diversity and inclusion, nurturing relationships, and encouraging an entrepreneurial spirit underpin our commitment to being a responsible employer.

As evaluated by an independent agency we currently hold a Level 1 BBBEE rating.

We offer a range of local and offshore investment strategies that meet the needs of retirement funds and individuals in Southern and Sub-Saharan Africa. We are dedicated to managing and growing our clients’ investments in a socially sustainable manner. Our clients are mainly institutional investors with a growing offering of retail investors.

Mergence was a pioneer in impact and infrastructure investing, with a rich history showcasing the advantages of uncorrelated alternative investments. We strongly advocate for the potential of these investments to deliver consistent long-term returns while making a positive social impact. Our diverse portfolio encompasses a wide range of debt and equity asset classes carefully chosen from sectors that global and national organisations have identified as high-priority areas.

This Fund aims to invest in a diversified combination of infrastructure risk-adjusted returns, whilst supporting the development of both social and economic infrastructure services. The Fund forms part of the Mergence suite of impact funds. The Fund strives to generate attractive risk-adjusted returns over that of the FTSE/JSE All Bond Index (ALBI).

The Mergence Infrastructure & Development | Debt Fund has a long-term performance target of inflation +3% per annum over the medium to long term by investing in opportunities that create both a positive and measurable social, developmental, and/or environmental impact.

Our specialist equity mandates aim to provide investors with capital growth over the long term. The key objective of these mandates is to consistently achieve returns that are in excess of the respective benchmarks over any rolling three-year period, without exposing the client to excessive risk. We embrace a style-agnostic approach and have a strong bias towards quality at a reasonable price.

The objective of these Funds is to provide commercially viable investments into the renewable energy sector enabling investors to achieve targeted investment returns together with social and environmental impact. Through both these Funds, we are invested in 13 renewable energy projects within Southern Africa, across both wind and solar. Fund II is open for investment.

This Fund aims to invest in a diversified combination of infrastructure risk-adjusted returns, whilst supporting the development of both social and economic infrastructure services. The Fund forms part of the Mergence suite of impact funds. The Fund strives to generate attractive risk-adjusted returns over that of the FTSE/JSE All Bond Index (ALBI).

Our specialist equity mandates aim to provide investors with capital growth over the long term. The key objective of these mandates is to consistently achieve returns that are in excess of the respective benchmarks over any rolling three-year period, without exposing the client to excessive risk. We embrace a style-agnostic approach and have a strong bias towards quality at a reasonable price.

The objective of these mandates is to achieve returns that are in excess of the FTSE/JSE Capped Shareholder Weighted Index (Capped SWIX) over any three-year rolling period without exposing the Fund to excessive risk. These core mandates target maximum active returns relative to tracking error volatility.

The Mergence Equity Prime Fund is a collective investment scheme fund that aims to provide investors with capital growth over the long term by achieving returns that are in excess of the FTSE/JSE Capped Shareholder Weighted Index (Capped SWIX), without exposing the Fund to excessive risk.

The objective of these mandates is to achieve returns that are in excess of the FTSE/JSE Shareholder Weighted Index (SWIX) over any three-year rolling period without exposing the Fund to excessive risk. These core mandates target maximum active returns relative to tracking error volatility.

Our range of multi-asset strategies include absolute return and balanced mandates. These products are developed for institutional and retail investors who seek a product which is broadly diversified across asset classes including equities, listed property, conventional bonds, and inflation-linked bonds both domestically and internationally.

This collective investment scheme fund is managed with the objective of producing a real return of 4% above inflation per annum over the longer term while preserving capital over rolling 12-month periods. The Fund employs active asset allocation and derivative hedging to manage and reduce downside risk. It is broadly diversified across asset classes including equities, listed property, conventional bonds and inflation-linked bonds, both domestically and internationally.

The Fund is managed with the objective of producing a real return of CPI plus 4% per annum over the longer term while preserving capital over rolling 12-month periods. It may underperform relative to overall equity markets due to its focus on capital preservation and long-term capital growth.

These Regulation 28-compliant mandates aim to generate stable long-term returns through exposure to a broadly diversified set of asset classes including equities, listed property, conventional bonds, and inflation-linked bonds, both domestically and internationally. It is managed with the objective of producing a real return in excess of 5% per annum above inflation. Derivatives may be used for the purposes of hedging or return enhancement. The inclusion of international assets broadens diversification and should enhance risk adjusted returns.

This Fund aims to invest in a diversified combination of infrastructure risk-adjusted returns, whilst supporting the development of both social and economic infrastructure services. The Fund forms part of the Mergence suite of impact funds. The Fund strives to generate attractive risk-adjusted returns over that of the FTSE/JSE All Bond Index (ALBI).

These portfolios aim to consistently outperform the benchmark over a 12-month rolling period while providing liquidity at a low level of risk. These well-diversified portfolios implement a range of South African money market instruments.

This Fund aims to invest in a diversified combination of infrastructure risk-adjusted returns, whilst supporting the development of both social and economic infrastructure services. The Fund forms part of the Mergence suite of impact funds. The Fund strives to generate attractive risk-adjusted returns over that of the FTSE/JSE All Bond Index (ALBI).

Mergence is an independent asset management firm with a strong 18-year track record. We were founded in 2004 and have successfully grown our offering to a diverse product range across both public and private market investments, spanning specialist equity and fixed income, multi-asset, infrastructure, debt and private equity funds.

We are focused on sub-Saharan markets and led by a pragmatic, sustainable, shared value creation mindset. Responsible investing and ESG principles are part of our ethos and embedded across our investment processes.

Mergence is majority black-owned and managed and embraces the multi-cultural and multi-racial diversity of Southern Africa. We employ 58 people across our operations in Cape Town, Johannesburg, Windhoek, and Maseru.

At Mergence we value our people. Our culture is characterised by a collective focus on excellence and development, keeping our staff motivated and committed to growing with Mergence and growing our clients’ savings.

Our senior investment team have worked together for nearly a decade. With over 300 years of combined experience our entire team, including analysts and fund managers, have distinct specialisation in both Public and Private Markets. We leverage data and key elements from each area to widen our perspective and innovate to obtain outperformance.

Bachelor of Management Science (Finance)

MBA (Finance)

Masimo co-founded Mergence Africa Holdings in 2004 with the vision to create a world-class diversified group. With R42 billion in assets under management, the group spans asset management, derivatives trading, property, and industrial holdings. The primary subsidiary is Mergence Investment Managers, with a dual capability across Public and Private investment markets. Masimo is an entrepreneur by nature and believes fervently in “creating shared value”.

MTech (Marketing)

BTech (Marketing)

Associate Financial Planner (AFP)

Certificate of Proficiency (Retirement Funding), Institute of Retirement Funds

Bongani joined Mergence Investment Managers in January 2009 in the Business Development team. He has 25 years of experience in the financial services industry, where he built an extensive network. His experience includes working as an institutional sales executive in employee benefits, and a manager in corporate social investment and transformation. Bongani sits on the Mergence Group executive committee.

BA (Political Science)

Executive MBA

Nyonga Fofang, Independent Non-Executive Director at Mergence, has 25+ years of capital markets experience, specialising in private equity, M&A, leveraged finance, and general management. He co-founded and leads Bambili Group Investment Pty Ltd, a pan-African investment holding company. Nyonga also serves as a director at SourceTrace LLC in Boston. He began as a closed-end fund Equity Analyst at PaineWebber Inc. and holds degrees from Harvard University and UC Louvain.

BSc (Chemistry)

BTech (Ceramic Science)

MSc (Engineering)

MBA (Administration)

Sholto joined Mergence in July 2022. He has more than 15 years’ experience in financial services with a focus on strategic leadership, product innovation, and research across all asset classes in Public and Private markets. He held various senior roles at the Public Investment Corporation including Acting Chief Investment Officer. Before entering the financial services sector, Sholto pursued a specialised career in resources and precious metals.

Diploma (HR Management & Training)

Karen joined Mergence in February 2014 as Office Manager. In December 2017, she was promoted to HR Manager. Karen has 27 years of experience in office management and finance, having worked at several large corporates before joining Mergence. In acknowledgement of the importance of our people, Karen was appointed to the executive committee of Mergence Investment Managers in October 2022.

BCom Hons (Economics)

MCom (Economics)

MCom (Finance & Econometrics)

Peter joined Mergence in 2014 as a Senior Equity Investment Analyst specialising in the TMT sector. He became a portfolio manager in 2016 and head of the listed equities team in 2019. Peter has over 15 years’ experience in the financial services industry, having worked for several global investment banks. He won ABSIP equity analyst of the year in 2011 and has worked as a university lecturer in economics.

BAcc Hons

CA(SA)

Izak brings over 15 years of financial services experience to his role as Portfolio Manager at Mergence. He co-managed portfolios from November 2019 to December 2022, having joined the team in 2011 as an equity research analyst and dealer. His current focus encompasses resources, beverages, luxury goods, and healthcare. His background extends to being an investment committee member in private markets and an audit manager at PwC prior to joining Mergence.

BCom Hons (Financial Management)

In 2023, Salome re-joined Mergence as a Senior Investment Analyst, having worked in the company in a trainee capacity before. With a focus on the retail and industrial sectors, Salome brings valuable experience from previous roles at local asset managers and a global investment bank over an eight-year career in the financial services industry.

BCom (Financial Analysis & Portfolio Management)

MSc (Chemical Engineering)

Malose joined Mergence in 2022 as an Investment Analyst. With 20 years of experience, she has a solid background in chemical engineering and financial analysis. Malose previously worked as a process engineer at Sasol, Project Services Group, and Chevron. She also served as a sell-side equity research analyst at Primaresearch. Additionally, she has lectured in her field at the CPUT and provided consultation to 4th-year Design Course students at UCT.

BCom (Economics Science & Business Finance)

Radebe joined Mergence in March 2021 as Investment Analyst in the Public Markets equity team based in Johannesburg. He currently covers banks, insurance, and other financials. With five years of experience, Radebe has in-depth sector knowledge across SADC, most notably in the banking, precious metals, and telecom sectors. In 2017 he won the ABSIP award for Research Analyst of the Year.

BCom Hons (Finance/Investments), BCom (Economics and Finance)

Keagan Martin joined Mergence in 2021 as a Client Relationship Manager, following his experience at Prudential Investment Managers. In 2023, he transitioned into an Investment Analyst role in the public markets’ investment team, where he now specialises in small to mid-cap industrials and food producers.

BSc (Actuarial Science & Mathematical Statistics)

BSc Hons (Advanced Mathematics of Finance)

Exec Masters (Finance)

CFA® Charterholder

Mohamed joined Mergence in March 2021 as Head of Fixed Income: Multi-Asset Class. He has 14 years of experience. Mohamed is responsible for a stand-alone fixed-income product and integrating a fixed-income investment process into the overall multi-asset strategy. He is the primary portfolio manager for the Mergence Composite Bond Fund and lead investment manager for the Money Market and Multi-Asset Income portfolios.

BSc (Actuarial Science)

PGDip (Management in Actuarial Science)

Fazila joined Mergence in September 2020 as a Portfolio Manager in the Multi-Asset team. She has over 18 years of experience in the financial services industry, and a passion for research, technology, and sustainability. At Mergence, she is responsible for developing quantitative and systematic strategies across balanced and absolute return funds while also managing portable alpha strategies.

BCom Hons (Financial Analysis & Portfolio Management)

BSc Hons (Biotechnology)

Unathi joined the Mergence Public Markets Investment team in July 2020 as an Investment Analyst in the Multi-Asset team. She has ten years of asset management experience and is completing her BCom Master’s degree in Applied Finance at UCT. Her primary focus at Mergence is a top-down and bottom-up analysis of the South African property sector.

BSc (Mathematics & Statistics)

BSc Hons (Mathematics of Finance)

Financial Risk Manager (FRM)

MBA

Morgan joined Mergence in 2018. He has over 15 years of experience in the financial services industry. At Mergence, he has oversight on the generation and monitoring of investment risk metrics for Mergence portfolios including performance metrics, market risk, etc. In addition, he also has oversight on the compliance function pertaining to the Public Markets portfolios.

BCom (Economics, Risk, and Investment Management)

Jeandre joined Mergence in 2023 as an Investment Risk & Analytics analyst, bringing three years of industry experience. Notably, he honed his analytical skills and became the youngest team leader at Burgiss during his tenure as a Private Equity Data Analyst. His strength lies in working with databases and excelling at identifying errors and outliers through data manipulation.

BSc Hons, MCom (Financial Management), ACCA

16 years industry experience; 12 years with Mergence

Chito joined Mergence in 2011 as an equity analyst in the public markets’ investment team focused on FMCG, hospitality, financial services, and telecommunications before transitioning to the private markets investment team in 2015. As Investment Principal, Chito focuses on private market investment opportunities within SADC. He has led transactions in the aquaculture and microfinance sectors and serves on the boards of several investment companies.

BCom (Investment Management and Banking), BCom Hons

1 year industry experience; 1 year with Mergence

Linkeng joined Mergence Investment Managers (Lesotho) in 2022 as a trainee analyst, where she supports the investment analyst team within private markets. Her role encompasses assisting with the origination of opportunities and guiding them through the investment process to implementation. Linkeng has team leadership skills, having been an SRC exco member at university.

BA (Economics)

PGDip (Property Management & Development)

MCom (Finance & Investments)

Ntsebeng joined Mergence Investment Managers (Lesotho) as a Property Analyst in 2022. She has five years of experience, including time spent as a real estate specialist and data analyst. Her responsibilities at Mergence include analysing the economic drivers of the commercial property portfolio and assessing the financial opportunity for existing and potential property investments.

Business Day TV: Three shares to buy in a world of junk

Watch

Related Posts

Monitoring operational performance at Eskom and Transnet

South Africans are currently experiencing the longest stretch of uninterrupted electricity supply in two years. While the lack of loadshedding

Monitoring operational performance at Eskom and Transnet

South Africa is currently experiencing its longest stretch of continuous electricity provision in two years. While the lack of load

Will an acceleration in growth lead to a pick-up in inflation?

As the fall in US inflation slows and economic growth starts to rebound, the question arises: can inflation continue to